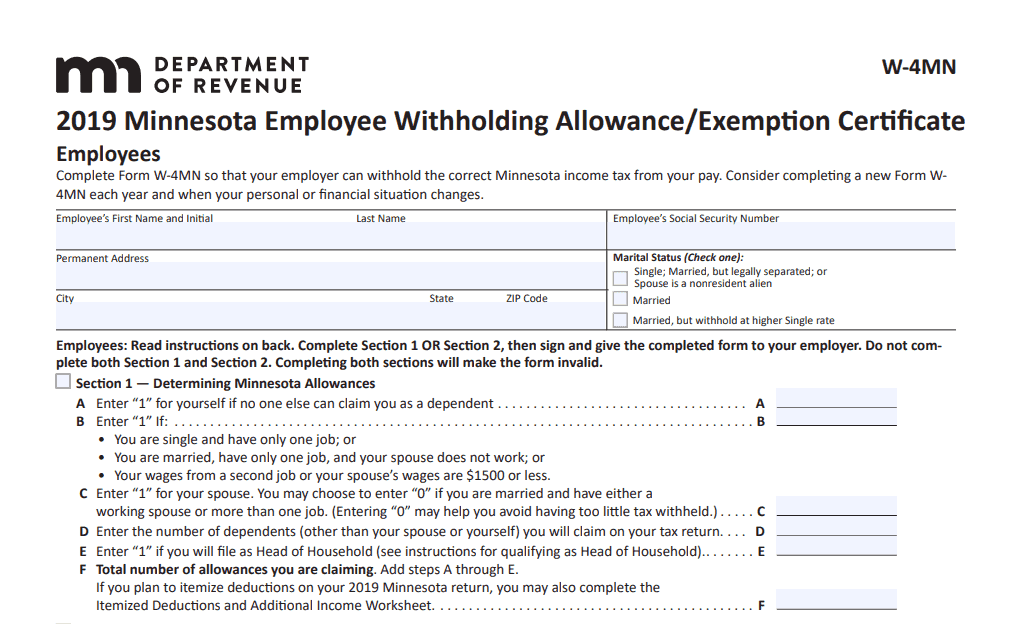

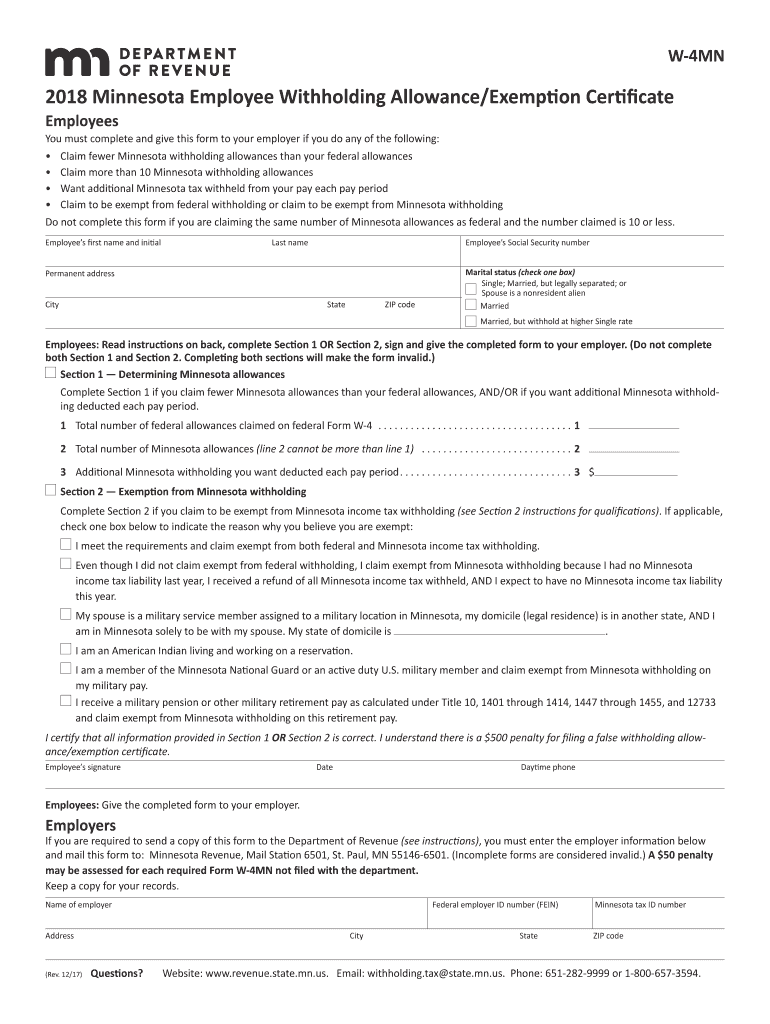

Mn State W4 2025. You then send this money as deposits to the minnesota department. Updated on jul 06 2025.

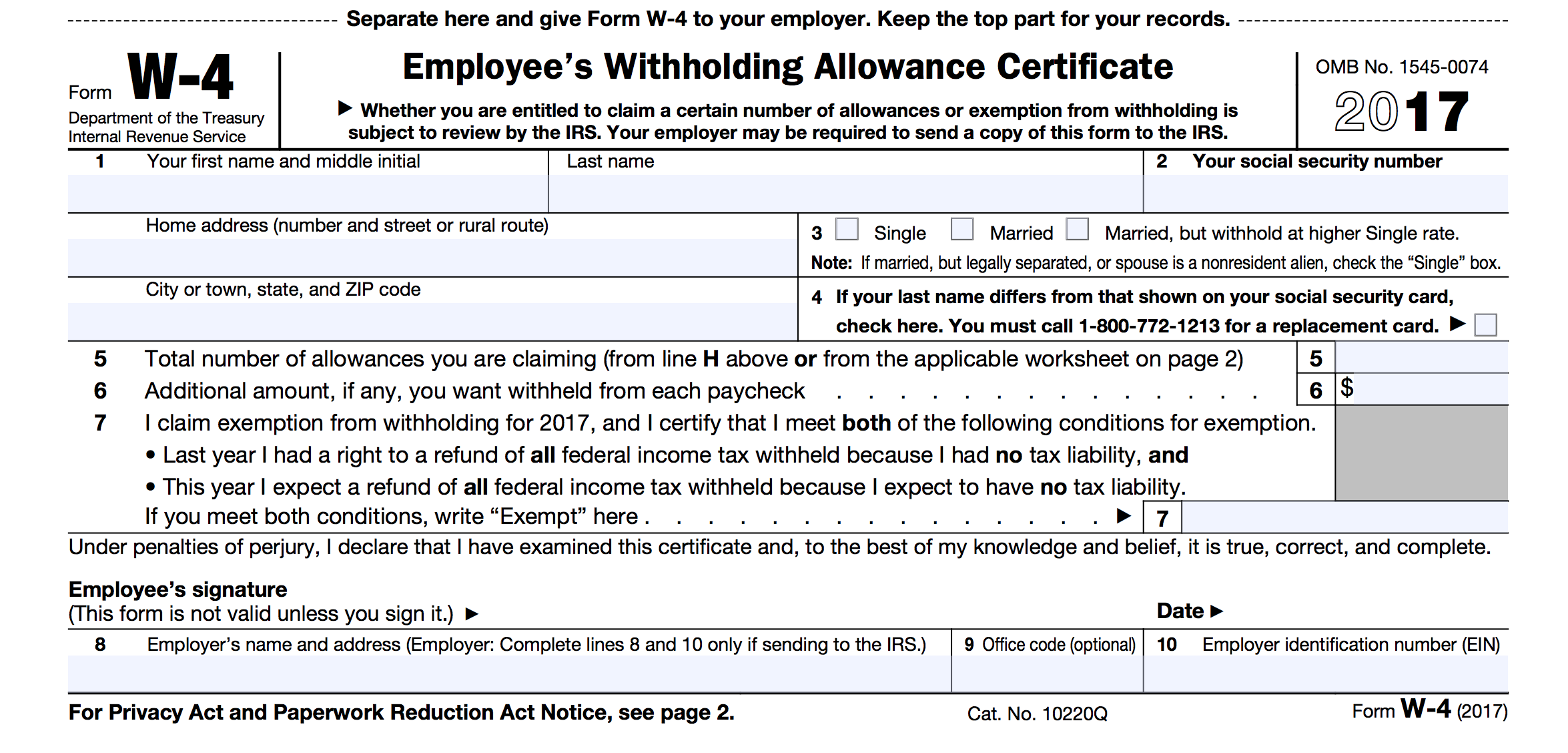

Minnesota requires nonresident aliens to claim single with no withholding. State income tax rates range from 5.35% to 9.85%, and the state’s sales tax rate is 6.875%.

Mn W4 Form 2025 Dulce Glenine, Minnesota’s withholding methods were updated for 2025, while changes to the state withholding certificate for pensions were made earlier in 2025, the state revenue. Minnesota withholding tax is state income tax you as an employer take out of your employees’ wages.

Mn W4 Form 2025 Lorna Rebecca, Beginning with payments made on or after january 1, 2025, minnesota requires withholding on annuity and pension payments unless the recipient asks you not to withhold. Your employees must complete form w.

W4 Form 2025 Mn Amil Maddie, State income tax rates range from 5.35% to 9.85%, and the state’s sales tax rate is 6.875%. Minnesota’s withholding certificate for pensions and annuities was updated following legislative changes earlier in 2025 and a draft version of the form, the state revenue.

Minnesota State Withholding Form 2025 Trix Alameda, W4, and minnesota state w4 information. This calculator allows you to calculate federal and state withholding.

W4 2025 Mn Wilma Juliette, Minnesota’s withholding certificate for pensions and annuities was updated following legislative changes earlier in 2025 and a draft version of the form, the state revenue. Free tool to calculate your hourly and salary income after federal, state and local taxes in minnesota.

W4 Form 2025 Mn Amil Maddie, Estimate of additional mn standdard deduction extimate of your taxable nonwage income total number of. The state of minnesota has a progressive income tax,.

2025 Form 2025 Dela Monika, Minnesota offers a number of tax deductions and credits that can reduce your. Free tool to calculate your hourly and salary income after federal, state and local taxes in minnesota.

W4 2025 Mn Cammy Corinne, Minnesota’s withholding methods were updated for 2025, while changes to the state withholding certificate for pensions were made earlier in 2025, the state revenue. State income tax rates range from 5.35% to 9.85%, and the state’s sales tax rate is 6.875%.

W4 Form 2025 Printable Pdf Free Download Nelie Hildegaard, The state of minnesota has a progressive income tax,. Minnesota state consists of 33 public colleges and universities with 54 convenient campuses throughout minnesota.

New W4 Form 2025 Explanation Jacky Liliane, For tax year 2025, the state’s individual income tax. Free tool to calculate your hourly and salary income after federal, state and local taxes in minnesota.

In minnesota, as in every other state, your employer will withhold 6.2% of your earnings for social security taxes and 1.45% of your earnings for medicare taxes, every pay period.

Minnesota’s withholding methods were updated for 2025, while changes to the state withholding certificate for pensions were made earlier in 2025, the state revenue.